- Based on perceived data quality, how will blockchain technology impact account holder happiness in the financial intermediation industry?

- What impact may sustainable banking practices have on the relationship between blockchain technology and client satisfaction?

- To what extent do green banking practices enhance the positive effects of blockchain technology on customer satisfaction?

- How do banking professionals see blockchain technology being leveraged to deliver sustainable and customer-focused financial services?

Abstract

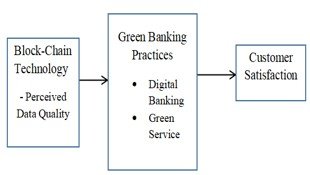

The international monetary landscape is undergoing rapid transformation as a result of the increasing emphasis placed on sustainability, transparency, and cutting-edge technology. Blockchain technology has become a game-changing tool in the field of energy savings, especially in the field of ecological financial assets. This study considers the relationship between customer satisfaction and BCT, explained through PDQ, using two dimensions of GBP as a mediating variable. This study based on the (TOE) approach, employs a quantitative methodology to gather information from 399 banking industry professionals. The findings suggest that PDQ which also indirectly impacts CS through GBP, has a significant impact on the adoption of blockchain technology. The mediating role of GBP shows how technological innovation advances sustainable finance goals and improves customer-centric consequences. This study adds to the burgeoning literature on eco-fintech by filling a critical gap.

Keywords

Block Chain Technology, Green Banking Practices, Consumer Satisfaction, Perceived Data Quality, Digital Banking

Introduction

The emergence of Eco-FinTech is causing a significant shift in the financial industry because traditional banks are facing increasing pressure to lower their carbon footprint and provide environmentally friendly financial services that combine sustainability and financial technology (FinTech) to support green banking solutions and guarantee transparency in green investments (Mir & Bhat et al., 2022). Recent research presents a novel perspective on how blockchain technology, digital technology, and green finance may boost productivity, encourage sustainable economic growth, and help address these issues by facilitating decentralization, security, and transparency in financial transactions while also increasing the competitiveness of national economies (Zhang, 2022). Despite these potential benefits, green finance transactions are guaranteed to be effective, auditable, and impermeable thanks to smart contracts and the immutable ledger of blockchain technology. The use of blockchain technology in sustainable banking and eco-fintech, which increases consumer happiness and trust, is yet mainly untapped, particularly in developing countries like Pakistan (Ali, 2022). Although previous studies have concentrated on Green Banking Practices (GBP) and customer satisfaction, little is known about how blockchain technology may benefit Eco-FinTech.

The focus of current research is on the gaps in knowledge regarding green banking and customer satisfaction. Fewer studies have been done on how blockchain technology may boost the adoption of green financing in developing countries like Pakistan (Mavlutova et al., 2025). By looking at the use of blockchain technology as a key component of ecologically sound banking Practices. Blockchain applications, sustainability, and FinTech and Banking Innovation Research's role in improving customer endorsement are not integrated into the Eco-FinTech sector; this paper bridges the gap by focusing on decentralized operation, security, and trust (Mir et al., 2025).

Although Green Banking Practices (GBP) have been extensively promoted as a way to promote sustainable financial services, there are a variety of environmental issues that affect our society and economy. Numerous barriers limit consumer satisfaction with green banking firms in this fragile climate, and corporations go above and beyond profit to significantly contribute to economic growth, emissions reduction, and the preservation of natural resources. Particularly a lack of transparency; they must be taken into account. Consumers are concerned about banks truly funding environmentally friendly initiatives since these elements may have an impact on how consumers interact with the technology (Queiroz & Fosso Wamba, 2019). Centralized Control: Blockchain is thought to display these same traits, and managers who are ready to do so are more likely to position themselves and their companies for long-term success. Traditional banking systems' dependence on outside organizations may slow down eco-friendly financial innovations. Security Issues: Blockchain technology, which has gained popularity as an operational innovation, is vulnerable to fraud, data privacy issues, and cyberattacks. These threats are quickly becoming a part of the humanitarian supply chain and comfort logistics environment (Sahebi, Masoomi, & Ghorbani, 2020).

The adoption of blockchain technology in sustainable banking is limited. Despite the fact that blockchains are widely used in both cryptocurrency and mainstream finance, the monitoring system and encryption techniques effectively protect the data from unwanted access. Its potential in green banking and eco-fintech is not well understood (Woodside, K, & Giberson, 2017).

With an eye on the mediating role of ethical banking procedures like computerized banking and green assistance, this study seeks to learn how client expectations and delight are impacted by sustainability-oriented digital innovations. It also looks at the impact of perceived data quality on consumer endorsement in the financial services field.

Research Questions

Literature Review

Perceived Data Quality as a Measure of Blockchain Technology and Consumer Satisfaction

Vern and Kamble (2024) Assert that the blockchain invention is being quickly implemented nowadays due to its capacity to provide data confidentiality, integrity, and swift transactions. The term "blockchain" Written by Wakefield Scott Introduced in 1991, the Trust-Commitment Theory profoundly affects how risk-free data is viewed and how overseas payments are handled, perhaps leading to higher customer satisfaction with reliable, clear, and high-quality data. Every block is linked together and directly affects customer confidence in maintaining data and protecting information (Morgan & Feng, 2024; Srfaraz et al., 2025). Customer satisfaction is a key outcome of green banking practices, and studies show that clients want more environmentally friendly financial services (Kumar, Luthra, & Jainr et al., 2023). Customer satisfaction with green banking can lead to increased loyalty, retention, and positive word-of-mouth (Mir & Bhat et al., 2022). By making it simpler to monitor, blockchain-based solutions can reduce the risk of greenwashing. Because they are decentralized, secure, transparent, and confirm green investments, they are ideal for promoting green banking practices (Cappiello, Comuzzi, Daniel, & Meroni, 2019). It has been established that perceived data quality is an important factor in determining a variety of consumer satisfaction indicators, particularly when it comes to information systems and cutting-edge technologies like blockchain. Considering the technological group of systems is made to offer decentralized, secure services that monitor everything and give verified information, it is more challenging for someone to commit fraud or network tricks since users have more faith in the systems (Lacity & Khan, 2018). The idea of perceived data quality, or high-quality data, is particularly important in the realm of blockchain as it eliminates the need for a strong person in charge and improves customer experiences by reducing uncertainty through accurate and transparent data. It protects your transactions with extreme care and boosts your client's happiness with digital offerings (Xu et al., 2019).

H1: Customer satisfaction in the banks is positively impacted by perceived data quality.

Perceived Data Quality and Green Banking Practices

The intelligence efficacy of data, including rapidity, accountability, consistency, and productivity relevance using ecological criteria, is characterized as perceived data quality (Wang et al., 2023). When smart contracts and record immutability are coupled, decentralization and the removal of third parties are frequently improved in blockchain-based systems, allowing real-time validation and guaranteeing a high degree of security (Tsai et al., 2023). One of the main user concerns is the significant changes brought about by technology. Enhancing the quality of data and the effectiveness with which blockchain technology is applied while interfacing with digital systems is measured by PDQ. Furthermore, one of its most significant contributions to enhancing corporate life is the perception of data quality, which has a substantial influence on customer happiness and confidence in digital and green financial services (Al-Shammari, Al-Amro, & Al-Motairi, 2021). When data openness and integrity grow, individual PDQ increases because customer satisfaction is a function of the quality of the information that is given to them, and quality is particularly important in the financial and corporate arenas (Xu, Chen, & Kou, 2019). In the scope of the Technology-Organization-Environment (TOE) Customers are less price-sensitive and often willing to pay more for eco-friendly products when they are aware of environmental issues. They also engage with and assess blockchain infrastructure because they think that by doing so, they can help preserve the environment in terms of perceived data quality (Oliveira et al., 2014).

H2: Green banking practices utilize blockchain technology's positive adoption of green services and digital banking.

Customer Satisfaction and Green Banking Practices

In today's monetary services industry, Buying eco-friendly goods, valuing sustainable consumption patterns, and supporting eco-friendly businesses are essential for boosting customer satisfaction and encouraging consumers to spend more money on eco-friendly products by improving the effectiveness, accessibility, and security of finances (Shaikh & Amin, 2024). By enabling customers to conduct sustainable transactions without the need for physical branches, digital banking has become a global trend in the development of online platforms, mobile banking, and other innovative channels. This improves overall service quality and consumer convenience and significantly increases customer satisfaction by offering protection, accessibility, and competitiveness (Iyer et al., 2023). Furthermore, because it allows the customer to choose more ecologically friendly products, digital and green banking services that match banking practices with environmental ideals like paperless banking, eco-friendly lending, and sustainable information technology are essential to green banking. According to Bansal (2014), a product with a greater green degree is one that offers significant benefits, is less harmful to the environment, and is more ecologically friendly than conventional banking procedures. It has been found that integrating digital banking with green services greatly increases satisfaction among consumers. Consumers seeking to expand market penetration for green products already on the market should participate in marketing initiatives that target growing consumer concerns about environmental quality (luo et al., 2020). Customers who have a higher perception of greenness benefit from the ease of use offered by digital banking systems to enhance environmental ecology and find user-friendly, intuitive digital interfaces. They also develop more positive moral judgments related to green services and provide a solid basis for customer loyalty.

H3: Green banking practices including green services and digital banking have strengthened the relationship with consumer satisfaction.

Green Banking Practices as a Mediator between Blockchain Technology and Customer Satisfaction.

The umbrella term "green banking practices" includes digital banking and green services like eco-friendly loans, modern cyber defense, and sustainable investing. Every consumer in the market is choosing eco-friendly products and practices with biodegradable packaging and promoting sustainable development for quick and economical processes (Mavlutova et al., 2025). Customers can now access banking services from anywhere at any time to save money, including ATMs, credit and debit cards, and digital interaction to encourage the use of online banking, investments, electronic fund transfers, and payment apps (Al-Shammari & Al-Amro, 2023). Digital banking's capacity to increase electronic transactions while decreasing paper use can result in a lighter carbon footprint. Digitalization refers to the use of cloud, social, mobile, and big data technology. However, the internet and mobile baking have expanded these points of engagement (Chiu et al., 2012). Since digitization has drastically changed the way information is stored and transferred, it also offers the ability to improve energy consumption and limit environmental waste in recent years. Service quality is greatly impacted by PDQ in banking, which includes removing customers' in-person interactions with banks, security, and correctness (Liu et al., 2020). This gap is filled by using digital banking techniques. If customers believe the data is of high quality, automatic, and consistent with their values, they may value and trust banks' green services more, which will increase transparency, the efficiency of banking operations, and usability, leading to higher customer satisfaction and digital literacy (Homburg et al.,, 2013). Environmental sustainability has been shown to be significantly improved by green banking practices such as digital banking and green services (Mir & Bhat et al., 2022) Customers may be encouraged to adopt environmentally friendly activities through green services such as green credit cards and eco-friendly loans (Kumar et al., 2020).

H4: Green banking practices mediate the relationship between blockchain technology and consumer satisfaction.

Technology Organization Environment (TOE) Theoretical Foundation

It is based on the Technology, Organization, and Environment (TOE) framework, which is commonly used to explain how banks embrace and integrate new technologies to enhance business intelligence systems, the primary elements impacting innovation are corporate, electronic, and atmospheric (Baker, 2011). The external environment, which includes consumer demands, market competitive dynamics, and the acceptance of green energy, promotes the use of green technologies According to (Nguyen, Le, & Vu, 2022), CS gauges environmental response to show how external stakeholders see the bank's eco-innovation initiatives. In this context, CS is beneficial in measuring environmental response, showing how internal and external forces and resources see the bank's desire for eco-innovation incentives. The organization's environmental strategy, hiring the appropriate personnel, and attempting to integrate sustainable new technology practices into its operations are all reflected in Green Banking Practices (GBP). How well blockchain can help leadership will depend on the organization's clear digital strategy to hire qualified personnel and have a robust IT environment and technology department. Think of the next-generation business insight's adaptable and safe features as a revolutionary development that may assist draw in more clients. It is perfect for supporting green financing projects because of its decentralized and unchangeable impact on all sectors of the economy, as it may lead to new business prospects in addition to promoting environmental safety (Prakash, 2025).

Research Methodology:

Design and Measurements of Questionnaires

This quantitative research introduced a statistical way survey-based approach for comparing green services and tech-driven banking shifts based on the TOE framework to determine green banking practices modernization variables (Fischer, Boone, & Neumann, 2023). This study assesses customer satisfaction through BCT's perceived data quality and the influence of GBP.

Procedure for Sampling

A non-probability design was employed in the current research, and participants were selected using a convenient selection technique, because of accessibility issues and scheduling constraints (Zhang, 2022) used the Tanaka Formula to determine the sample size. A research study of the target market consisting of 340 IT professionals and sustainability officers employed by Pakistan's banking industry was conducted to validate the questionnaire and ensure that the items were comprehensible. Data was gathered through surveys done both locally and online. All subjects provided prior consent, and anonymity was ensured. A confirmatory factor analysis was used to ensure the accuracy and validity of the measurement model (Gerbing & Anderson, 1988). To ensure adequate statistical power, the full-scale investigation will use a larger sample size (minimum of 200) in accordance with structural equation modeling (SEM) recommendations. After analyzing the pilot data for initial reliability (Cronbach's Alpha) with SPSS, the complete dataset will be assessed using Structural Equation Modelling (SEM) via the Smart PLS. The data was collected using a standardized questionnaire. Five aspects from previous studies were used to build the PDQ of Blockchain Technology Scale measuring items (DeLone & McLean, 1992) (Aparicio et al., 2019). Using past research for cost-effectiveness, the four GBP components, a total of five elements were adapted for use with cloud access banking (Shaumya & Arulrajah, 2016). This study assessed eco-responsible services using five criteria from preceding studies (Parasuraman, 2019). The final section of the client fulfillment survey consists of seven questions that were extracted from earlier research (Hammoud et al., 2018). A Likert scale of 1 to 5 (strongly disagree to strongly agree) is used in the online questionnaire. Items like these were included in the demographic section: Gender, Age, Qualifications in Education, Title (e.g., Sustainability manager, IT officer), Years of banking experience, and Knowledge of blockchain or green technology Diversity and representativeness across employment roles are ensured by this information.

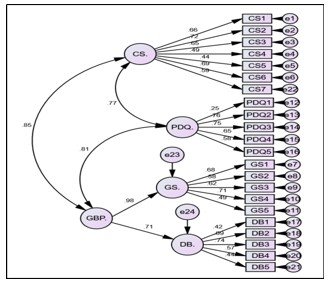

The Empirical Analysis of Results

According to the demographic statistics, male respondents constituted the bulk of the sample (74.0%), with female respondents accounting for 27.0%. Furthermore, those between their peak years of 41 as well as 50 had the largest percentage of replies (37%) and 31 to 40 (27.3% of the total). To check the validity and reliability of the variables, we first analyzed the reflective measurement model, followed by the quality tests provided by (Darsono et al., 2019; Hair et al., 2019). "Indicator loadings are the correlations between a specific factor and its items." Indicator loading and convergent validity reflect the parameter that controls items' loading exterior; for the study to be considered valid, it must exceed 0.708. Furthermore, the AVE, The convergence of accuracy check is a synonym for it, must be close to 0.50 or higher, while the reliability measure must be larger than 0.70 (Forero, 2023). The findings of all established parameters for outer loading, Cronbach's alpha, composite reliability, and average variance extracted were determined to be within the threshold limit, as were the characteristics of the reflected measurement model (Table 1). Consequently, Table 2 According to the Fornell-Larcker criterion, there is no difficulty with discriminant validity because the data in Tab 4 To satisfy the standards for discriminant validity, the AVE greater than the cut-off values also HTMT Value for every parameter must be a value below 0.90 (Henseler et al., 2015), and the HTMT approach indicated discriminant validity issues.

The HTMT approach identified issues with discriminant validity. Cronbach's alpha, composite reliability, and mean deviation obtained in the financial services institution were used to evaluate the dependability of account holders' happiness with privacy and climate-friendly activities. Cronbach's alphas for the GBP's digital banking, green services, green infrastructure, and green loans are all higher than the necessary minimum of 0.70, according to the standardized estimates and findings of the CFA model employed in the third tableau and the numbers (Fornell & Larcker, 1981; Lam et al., 2012).

Table 1

Descriptive Data

|

|

N |

Min |

Max |

Mean |

Std. Deviation |

|

CS |

399 |

1.86 |

5.00 |

4.0168 |

.66203 |

|

GS |

399 |

1.60 |

5.00 |

4.0080 |

.67275 |

|

DB |

399 |

1.00 |

5.00 |

3.7579 |

.69095 |

|

PDQ |

399 |

1.40 |

5.00 |

3.8005 |

.69405 |

|

Valid N (listwise) |

399 |

|

|

|

|

Table 2

Reliability

|

Variables |

No. of items |

Cronbach’s Alpha |

|

In overall |

22 |

0.898 |

The standardized estimates and results of the CFA model used in the study (Fornell & Larcker, 1981; Lam et al., 2012). Based on the alpha coefficients Cronbach's results, it is possible to conclude that the constructs' validity and the components evaluating internal consistency are appropriate.

Table 3

|

Demographics |

Sub Categories |

Frequency |

Percentage |

|

Gender |

Male |

293 |

74% |

|

|

Female |

106 |

27% |

|

Qualification |

Bachelor’s |

109 |

27% |

|

|

Master’s |

190 |

48% |

|

|

MPhil / PhD |

50 |

13% |

|

|

Professional |

50 |

13% |

|

Age in years |

21-30 |

93 |

23% |

|

|

31-40 |

107 |

27% |

|

|

41-50 |

130 |

37% |

|

|

51-60 |

69 |

17% |

|

Work Experience |

1-5 year |

17 |

18% |

|

|

6-10 years |

172 |

43% |

|

|

11-15 years |

65 |

16% |

|

|

16 -20 years |

52 |

13% |

|

|

21-25 years |

39 |

10% |

|

Job-Title |

IT/ Digital Banking |

199 |

50% |

|

|

Sustainability / ESG / Green Finance |

140 |

35% |

|

|

Operations / Strategy |

60 |

15% |

A total of 399 responses were collected and sorted by gender for statistical purposes. According to the participant profile indicated in the table below, approximately 74% were male and 27% were female. Customers in Lahore's banking industry who acknowledged the survey were Masters (48%) This suggests that since they had adequate practical understanding they were qualified to respond to the survey of their banks' CSR programs, PhD or professional degree holders (13% each), and Graduates (27%). Four groups were present: 20-30% (23%), 31-40% (27%), 41-50% (37%), and approximately 51-60% (17%). The statistics suggest that responses from people aged 41 to 50 account for more than 37% of the total. A total of five kinds emerged from the employment tenure and employment history entails: between youngsters of six and ten 43%, and one to five (10%) suggests the responder, 20 years representing a wide variety of professions, and 11 to 15 years (16%).

Table 4

Correlation

|

Items |

CS |

GS |

DB |

PDQ |

|

CS |

1 |

|

|

|

|

GS |

.656** |

1 |

|

|

|

DB |

.519** |

.567** |

1 |

.486** |

|

PDQ |

.604** |

.645** |

.486** |

1 |

The level of a positive or negative relationship between multiple factors is measured by an association. All diagonal values in these graphs show a significant strength and direction between all of the factors or pertinent items, with a two-tailed significance level of 0.001 and an allowable value of 0.07 (Naveed & Cheng et al., 2020).

Table 5

Discriminant Validity of HTMT

|

Items |

CS |

GS |

DB |

PDQ |

|

CS |

1 |

|

|

|

|

GS |

.656** |

1 |

|

|

|

DB |

.519** |

.567** |

1 |

|

|

PDQ |

.604** |

.645** |

.486** |

1 |

Based on the results it is possible to conclude that the constructs' validity and the components evaluating internal consistency are appropriate. The table above shows the value of discriminant validity at a significance level of.009. The DV is calculated using the HTMT AVE values (CS, GS, DB, and PDQ). The figures in the preceding list of columns and rows interpret computed value must fall within the specified boundary restrictions and be less than 0.9 (Hair et al., 2019).

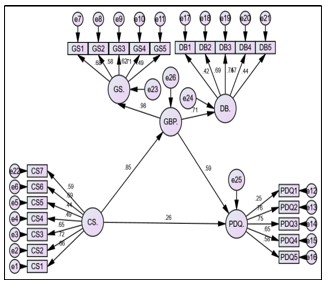

Testing of Structural Models and Hypothesis

Variance Inflation Factor (VIF) with unstable regression line parameters can be used to detect multicollinearity; if high, we need to combine or remove distinct variables to study. The multicollinearity test is used to gauge the strong straight relationship between any a couple or more x-axis independent predictors 5 (Hair et al., 2011) and <3.33 (Kock & Lynn, 2012). This is a desirable result because it demonstrates that the predictors are not redundant and that your regression model is functioning properly.

Table 6

Coefficients

|

Model |

Collinearity Statistics |

||

|

|

Tolerance |

VIF |

|

|

|

PDQ |

.518 |

1.931 |

|

|

GS |

.436 |

2.296 |

|

|

DB |

.630 |

1.587 |

|

|

CS |

.496 |

2.018 |

The study hypotheses were evaluated using the structure's SEM model and AMOS maximum likelihood estimations. Given the difficulty in identifying the effect in Table 3, VIF and tolerance values are not high-risk shows in this study, and values for all indicators are measured not similar or below the limit of 5. Empirical data showed that the values varied between 1.587 and 2.296, for the goal of evaluating the model, the presence of a collinearity problem was examined indicating that the values were below the generally accepted threshold limit of >5 (Hair et al., 2015).

Figure 1

Table 7

Model Fit Indices

|

|

X2/D.F. |

RMR |

GFI |

AGFI |

NF1 |

CFI |

RMSEA |

PCLOSE |

|

Cut off Data |

< 3 good; < 5 acceptable |

< 0.09 |

> 0.9 |

> 0.80 |

> 0.90 |

> 0.95; > 0.90; > 0.80 |

< 0.08 |

> 0.05 |

|

Outcomes |

2.512 |

0.031 |

0.900 |

0.910 |

0.890 |

0.916 |

0.047 |

0.116 |

Figure 2

Furthermore, the various model fit indices were utilized to assess the suitability of the structural model displayed in the data table below. The fit indices are: X2/D.F. = 2.512, p-value = 0.116, SRMR = 0.031, GFI = 0.900, AGFI = 0.910, and RMSEA = 0.047. Academics (Cohen & J., 2013) determined that all fit indices were well within the specified levels. Overall, the structural model is acceptable and sufficient. The hypothesis testing results significantly supported all four of the study's hypotheses. The research relied on a bootstrapping approach with 2000 samples to support its premises (Bonett & Bentler, 1980). The researcher adopts hypotheses H2 and H4, as BCT has a significant positive impact on GBP and CS (P = 0.001). Similar to H3, GBP supports the hypothesis by having a favorable and significant effect on CS. Additionally, PDQ has a beneficial impact on CS with P=0.001, supporting H1.

Accessing the Mediation

Figure 3

Table 8

|

Hypothesis |

D? W/O Med. |

D? with Med. |

I? |

Med. Type |

|

CSàGBàPDQ |

? = 0.632 p = 0.000 |

? = 0.243 p = 0.001 |

? = 0.250 p = 0.001 |

Partial Mediation |

Green banking practices have a partial influence on perceived data quality and customer happiness, as evidenced by the outcomes of noticeable direct effects. To investigate the mediation effect, we conducted bootstrapping with samples to generate both indirect and direct impacts. The indirect mediation had a positive and significant influence, as evidenced by a p-value of 0.000. Subsequently, we demonstrate the secondary effect of BCT on CS through DB and GS in the rows utilizing AMOS's bootstrap procedure (Hayes & Preacher, 2004) and GBP mediation between BCT and CS.

According to the data, the indirect influence is strong at 0.243 P values of 0.001 inconsequential. All of these studies suggest that DB and GS completely moderate the relationship between consumer happiness and blockchain technology. The researchers used the three-step methodology suggested by (Nitzl et al., 2016) to investigate GBP as a mediator between PDQ and CS. First, the specific indirect effect is computed. The importance of indirect effects in AMOS was then assessed using the bootstrapping technique. Bootstrapping is the process of randomly choosing a large number of subsamples from the original sample to allow for replacement. It is critical to emphasize that the number of bootstrap samples must be sufficient to produce trustworthy estimates and must at least match the number of valid observations in the dataset. Generally speaking, at least 5000 bootstrap samples are recommended (AL-Fadhali, 2022).

Table 8 displays the hypothesis and results, which indicate that digital banking and green banking practices, such as green services, significantly moderate the relationship between customer satisfaction and blockchain technology as evaluated by perceived data quality. However, it should be mentioned that the CS and PDQ outcomes via GBP were deemed insignificant (Hair, Sarstedt, Ringle, and Mena, 2012) and found the coefficient to be statistically significant at the 0.05 level. Indicate that the mediation can be determined using (VAF). The concept of variation accounted for (VAF) in academic research to assess how much all indirect effects contribute to the overall impact generally utilized.

Conclusion

According to the context of eco-conscious solutions, this study determines how blockchain technology influences consumer satisfaction and green banking practices, particularly when viewed through the lens of perceived data quality. The findings provide empirical replies to the proposed study subjects and are consistent with past research. First, in responding to RQ1, the findings reveal that blockchain technology considerably and favorably improves customer satisfaction when examined using perceived data quality (accuracy, timeliness, and reliability). This supports previous findings that improved data quality boosts client trust, particularly in digital banking (Wang et al., 2023; Tsai et al., 2022). Customers' trust in financial transactions is enhanced by blockchain's ability to produce secure and unchangeable records, which increases consumer satisfaction. Second, the study found that green banking practices significantly influence the relationship between blockchain and customer satisfaction in response to RQs 2 and 3. This shows that using blockchain enhances the efficiency of green banking services, such as eco-loans, paperless transactions, and transparent green services, resulting in increased consumer satisfaction. These findings are congruent with those of (Zarifis et al., 2022) who argue that environmentally friendly operations are critical to the reputation and performance of sustainable banking. Finally, response patterns and demographic analysis for RQ4 demonstrate that banking professionals see blockchain integration as a valuable innovation for customer engagement and sustainability. These findings are backed by the TOE framework's theoretical perspective, which emphasizes organizational responsiveness and technological readiness as critical enablers (Nguyen, Le, & Vu, 2022). The study's findings conclude that the use of GS improves the customer experience by strengthening the relationship between consumers and financial institutions acting as essential mediators also has implications for financial businesses seeking to improve customer satisfaction and promote sustainable practices. Green banking methods strengthen the link since they build trust, boost transparency, and improve For banks adhere to ESG guidelines, and create enduring client connections through innovation, the whole service experience even more by addressing clients' growing ethical and environmental concerns (Mir et al., 2025). Customers are better satisfied as a result of this alignment because they respect the long-term viability and functionality of banking services so this research also offers useful insights.

Limitations and Future Direction

Despite providing research information, the study has few limitations. Geographical limitation: The study's sample may have been geographically restricted, limiting the findings' application to other places with different environmental, cultural, or regulatory circumstances. The study's cross-sectional design limits the ability to make causal inferences. Longitudinal research may provide a more in-depth knowledge of how views regarding data quality and green banking evolve over time. Sample bias: Some customer categories, such as young, tech-savvy persons, who are more inclined to use digital and green banking services, may have been overrepresented in the study.

This study can be expanded upon in future research by investigating further mediators: Future research could investigate other potential mediators such as trust, perceived value, or service quality. Cultural norms may influence consumer satisfaction differently in different locations, researchers could look into how different cultures perceive data quality and green banking practices and the utilization of blockchain technology, green banking practices, and consumer satisfaction should all tested.

Research Contribution to Theoretical and Practical Implications

Improving data quality should be a primary focus for banks and other financial institutions offering services that can help organizations gain a competitive edge by altering their core competencies differentiable the bank from its competitors, and developing new ones to boost consumer satisfaction and confidence. To ensure outstanding client experiences, data must be used in a clear, accurate, and secure manner (Ogunmokun, Ikhide, Nedu Osakwe, & Jibril, 2024). The UTAUT and TAM mechanisms are expanded upon by green banking products, which enable banks to prioritize data convenience and integrity in their service offerings. This is because improved customer empowerment and control draw in customers and are valued by net zero banking practices, which have an impact on customer attitudes (Al-Momani & Ramayah, 2025).

The growing focus on sustainability in developing nations, where advancements in technology might lead to new opportunities. The study's theoretical ramifications lay the groundwork for future investigations into quantifiable environmental value generation, the adoption of green technology for effective operation, and opening the door to greater practical security. Future research could build on this work by examining how customer expectations are integrating and how carbon-conscious financial initiatives for overall market competitiveness to truly sustainable development goals and growth are necessary financial operations in an era driven by intelligence because the climate clocks are getting louder.

References

-

Al-Fadhali, N. (2022). An AMOS-SEM approach to evaluating stakeholders’ influence on construction project delivery performance. Engineering Construction & Architectural Management, 31(2), 638–661. https://doi.org/10.1108/ecam-09-2021-0780

-

Al-Momani, A., & Ramayah, T. (2025). The UTAUT Model in Understanding EHR Adoption: A Systematic Review. Studies in Computational Intelligence, 179–194. https://doi.org/10.1007/978-3-031-74220-0_14

-

Al-Shammari, M. A., Banerjee, S. N., & Rasheed, A. A. (2021). Corporate social responsibility and firm performance: a theory of dual responsibility. Management Decision, 60(6), 1513–1540. https://doi.org/10.1108/md-12-2020-1584

Cite this article

-

APA : Shahzadi, H. A., Khan, Z. U., & Amjad, R. (2025). The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction. Global Social Sciences Review, X(I), 312-327. https://doi.org/10.31703/gssr.2025(X-I).26

-

CHICAGO : Shahzadi, Hafiza Amina, Zargham Ullah Khan, and Rafia Amjad. 2025. "The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction." Global Social Sciences Review, X (I): 312-327 doi: 10.31703/gssr.2025(X-I).26

-

HARVARD : SHAHZADI, H. A., KHAN, Z. U. & AMJAD, R. 2025. The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction. Global Social Sciences Review, X, 312-327.

-

MHRA : Shahzadi, Hafiza Amina, Zargham Ullah Khan, and Rafia Amjad. 2025. "The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction." Global Social Sciences Review, X: 312-327

-

MLA : Shahzadi, Hafiza Amina, Zargham Ullah Khan, and Rafia Amjad. "The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction." Global Social Sciences Review, X.I (2025): 312-327 Print.

-

OXFORD : Shahzadi, Hafiza Amina, Khan, Zargham Ullah, and Amjad, Rafia (2025), "The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction", Global Social Sciences Review, X (I), 312-327

-

TURABIAN : Shahzadi, Hafiza Amina, Zargham Ullah Khan, and Rafia Amjad. "The Role of Eco-Fin Tech and Sustainable Banking with Blockchain Technology in Enhancing Customer Satisfaction." Global Social Sciences Review X, no. I (2025): 312-327. https://doi.org/10.31703/gssr.2025(X-I).26