Abstract

This study investigates the role of inflation as a mediator between currency depreciation and economic growth in Pakistan from 1972 to 2016. Using the Ng-Parron unit root test, the stationarity of the variables is determined. The outcomes of Ng-Parron unit root tests indicate that all variables in the model exhibit mix-order integration. This paper also employs the Autoregressive Distributive Lag Model (ARDL) to evaluate the relationship between currency depreciation, inflation, and economic expansion. The results show very clearly that the inflation rate does not play a role in the link between currency depreciation and economic growth in the case of Pakistan.

Key Words

Depreciation, Economic Growth, Autoregressive Distributed Lag Model (ARDL)

Introduction

Research Background

As depreciation is regarded as a crucial component of conventional stabilisation programmes, it has been assumed that exchange rate policy is an important policy. Depreciation refers to the decline in the value of a country's currency in comparison to other currencies. Depreciation causes an increase in the cost of imported goods in the home country and a decrease in the cost of exported goods abroad. Consequently, exports increase and imports decrease. This promotes exports while discouraging imports. Furthermore, depreciation can result in a shift of real income from wages to profits, as there are two consumer groups in an economy: wage earners and profit earners. Assuming that the marginal propensity to save (MPS) for-profit earners is greater than that of wage earners, this results in increased profits and stagnant real wages. Since the MPS for profits is greater than the MPS for salaries, this will reduce demand as the Average Propensity to Save (APS) increases (Eichengreen, 2007).

If a country has a predominant trade deficit, depreciation has a negative effect on total demand. With depreciation, a country's imports exceed its exports, and prices of traded items tend to rise, resulting in an increase in the foreigners' revenue and a decrease in the local country's income; the bigger the initial trade deficit a country faces, the greater the negative impact of depreciation. A depreciation of the currency lowers the prices of exportable goods and raises the prices of importable goods, leading to an increase in exports and a decrease in imports, as well as a shift in demand toward domestically produced goods, which improves the balance of payment situation of the depreciating country (Ahmed et al., 2013). For many emerging nations, depreciation has become a key growth challenge. It can have either an expanding or contracting effect on economic growth. It will boost the efficiency of businesses and the productivity of domestic industries. The manufacturing process of developing countries is highly reliant on imported inputs such as raw materials and capital goods; depreciation raises the cost of imported inputs, hence increasing the cost of production in the declining country. Ultimately, due to the increase in input costs, production will decline, resulting in a decline in total supply (Edwards, 1989).

According to (Akpan, 2004), to put it simply, an exchange rate is the cost of exchanging one currency for another. It measures the domestic significance of an economy, especially in terms of the currencies of the most developed economies in the world. Monetary policy has always been regarded as the primary tool by economies for achieving economic stability and sustainable growth. It follows that the exchange rate is linked with inflation; it stands for the general price level rise of products and services throughout a specific economy. Policymakers frequently set targets on mediating variables such as the ER, MS and IR to achieve the goal of macroeconomic stability. Among these variables, the exchange rate is considered to have a larger effect on the economy through its effect on inflation; prices of imports and services climb whenever the value of the currency declines, leading to higher CPI. The inverse consequences of inflation, which come from the volatility in the exchange rate, have been a great concern for policymakers, monetary authorities, and economists because of the fact that the exchange rate and inflation are the key variables that influence the macroeconomic performance of the economy. Furthermore, the exchange rate and inflation rate are very important due to their link with monetary policy. Because price instability is caused by fluctuations in the exchange rate, the exchange rate must be stable in order to achieve price stability. While analysing the long-term causes of inflation in an economy, the volatility in the exchange rate has remained the central issue.

The capacity of economic emergency through depreciation of the Pakistani currency can be analysed with the fiction that the Pakistani currency has been devalued against Indian, Nepal and Bangladesh currencies. Relentless depreciation in the Pakistan currency created imbalances in the current account deficit in Pakistan (SBP). According to the state bank of Pakistan, during the last decade (2000-10), Pakistan's currency has been devalued from 12% to 135% against the world developed currencies. In 2001, the worth of the US dollar was 58.4 rupees which increase to Rupees.90.55 in the year 2012, similarly, the worth of the British pound jumped to 143.9 rupees from 84.7 rupees, while the Australian dollar jumped from 31.2 rupees to 97.77 rupees, and the euro was raised from 55 rupees to 134.06 rupees. Indian rupees increased from 1.25 rupees to 1.80 rupees, and the Bangladesh taka increased from Rupees1 to Rupees 1.25. Although the worth of the Nepal currency and Japanese Yen was inferior in value to the Pakistani rupee, both currencies increased during that period. While comparing the Pakistani currency with the Muslim World's currencies, The Kuwaiti dinar hiked to rupees 381.6 fromRupees190.4.Saudi Riyal and UAE Dirham increased to rupees 24.12 and 24.78 from 15.5 and 15.9, respectively. The worth of the Pakistani rupee has also been depreciated, comprising of Krone of Norway, Swiss franc, Swedish Krone, Thailand Bhat, Singapore dollar and Malaysian Ringgit.

Currency Depreciation, Inflation and Economic Growth

From the traditional point of view, the exchange rate has not played a crucial role in determining the level of economic growth. The neo-classical economists have ignored the exchange rate in the various models of economic growth; rather they gave much attention to saving and investment as the key determinant of economic prosperity. From the above discussion, it is obvious that in the closed economy models exchange rate is considered as the ratio of non-traded goods in circumstances that it does not aid in the expansion of the economy. On the other hand, Inflation is a continuous and consistent increase in the general price level in the economy. Therefore inflation is basically a monetary trend. The inflationary phenomenon in the economy has been a source of fear for the economic systems, especially of the developing economies, due to its exceptional effect on the Current account balances, exchange rate volatility, GDP growth and economic instability. Further, inflation has a linkage with prices, which leads to the disequilibrium between efficient purchasing power and the existing output of goods and services in the economy. Therefore, inflation has been considered a key feature of economic instability. According to the Monetarist's theory of inflation, the inflationary situation is due to the excess supply of money over demand for money. Therefore, to control the inflationary pressure in the economy, the Monetarists recommended a restrictive monetary policy. On the other hand, there is another theory of inflation, which is known as the cost-push theory. According to cost-push theory, that inflation is an outcome of the wage increase to the pressure of unions as the wage is a key factor of production. The rise in the wages of labour will increase the total cost of production in the economy, which in turn leads to the rise in the general price level. The increase in the general price level, in turn, provokes labour into further campaigning for an increase in wages. The practice finally degenerated into an inflationary spiral. Therefore the theory considered wage freezes as the most effective instrument to control inflation.

Different parameters were used for measuring the inflation rate, like sensitive price indicator (SPI), wholesale price index (WPI) and consumer price index (CPI). The exchange rate and inflation show a significant increase in the level of money supply leads to a high-interest rate, and as a result price level will rise, which leads to an increase in exchange rate volatility (Ali et al., 2015). (Ahmad et al., 2013) reveals that in order to control inflation, strong management of monetary policy as well as tightening of the policy of real exchange rate would be required for Pakistan's economy. The current situation of the exchange rate is seemed to operate as overvalued; it must depreciate the rupees.

Literature Review

The literature on the relationship between inflation and economic growth presents different opinions. In the 1960s, due to the Philips curve, many scholars believed in permanent output–inflation trade-off. Conversely, the theoretical arguments of the various researchers did not go with the above opinion. However, recent empirical studies found a non-linear relationship between inflation and GDP growth. The results illustrated that inflation has no role in the determination of the economic prosperity of a country, until and unless it exceeds a specific threshold level, after that it negatively impacts economic growth. Further, the threshold level varies for different studies, depending on the size of the sample of countries, methodology of the analysis and time period. Moreover, during inflation, investors hesitate to invest more because of the money illusion. The inflation rate is significantly positively related to inflation volatility. It means to say that the higher the volatility in the inflation rate, the higher will be the inflation in the economy. This will lead to an increase the uncertainty among the investors, and they will not feel comfortable investing, leading to a reduction in long-term investment in the country (Romer, 1990). On the other hand, there are some arguments regarding the positive impacts of inflation on the economy. These positive impacts are based on three main arguments. First, there is a direct relationship between inflation and direct taxes as well as other indirect taxes. So inflation leads to the optimisation of taxes to the government. Second, the contractionary monetary policy of the central bank of a country to control inflation can restrict the central bank from responding to the adverse supply shocks in the economy. According to Krugman (1998), the restrictions on the monetary authorities of Japan to reduce the supply of money may have been a major cause leading to the stagnation of the Japanese economy during the deflation of 1990. Third and perhaps the most important, that during quick structure changes, the economy requires sufficient variations in price proportions. In this scenario, for fast modernisation periods, the lubricant inflation hypothesis is predominantly important, and disinflation policy obstructs economic growth. In addition, strong industrial and social policies can also generate a positive relationship between inflation and economic growth. As both kinds of policies can play a vital role in the sustainable growth of the economy, but at the same time, it also brings a risk of inflation to the economy. Additional, inflation and nominal exchange rate volatility lead toward real exchange rate dynamics, this brings a new aspect into the picture. According to the study by Calvo et al., 1995 that the stable rate of the real exchange rate is the one that ascertains the equilibrium in the balance of payment. The real exchange rate is considered to be the function of the level of development in the economy, in the long run. There are many explanations that why the equilibrium exchange rate in developing countries is well below the rate of purchasing power parity (Froot and Stein, 1991). As Balassa- samuelson effect revealed, the difference in the productivity between developed and developing economies is exist in the non-tradable sector rather than in the tradable sector. Yet wages are equal in both sectors. Similarly, the Bhagwati?Kravis?Lipsey effect revealed that non-tradable goods are labour intensive in nature and mostly they are services; hence if labour is economical in developing countries, prices for services (wages) should be lower (Polterrovich & Popov, 2006).

Literature Gap

Different studies have been made in order to examine the impact of the depreciation of currency on economic growth. However, this study adds something new to the existing literature. This study examines the mediating role of inflation in the relationship between depreciation of the currency and Economic growth by utilising time series data from 1972 to 2016, which is the reflection of the issue of depreciation by applying the new data set for Pakistan.

Exchange Rate and Inflation

Table 1.. Exchange Rate and Inflation Rate

|

Period |

Exchange Rate |

Inflation Rate |

|

1970s |

9.759454 |

13.43974 |

|

1980s |

14.73303 |

7.265555 |

|

1990s |

33.2645 |

9.715782 |

|

2000s |

62.39542 |

7.968101 |

|

2010-16 |

96.03763 |

10.23573 |

Source: Economic Survey of Pakistan (various Issues)

Inflation is one of the critical and debatable issues in the ups and downs of Pakistan's economy. The inflation rate was recorded at 3.3% in the decade of 1960s. But it rose to 13.4 per cent in the decade of 1970s and of the same as the above table shows 7.266 per cent in the decade of 1980s. Similarly, inflation became the subject of matter in the 1990s due to the reason of insufficient employment ratio as well as increasing price levels. (Pakistan Economic Survey, PES). At the initial time of 1972, there were only 5 rupees Pakistani equals one $US. After 1972 the exchange rate adopted the value of 10 rupees per dollar in circumstances of the depreciation process till 1982. The exchange rate fluctuated to 80 rupees per dollar over the coming two decades. The main role of depreciation in the exchange rate is further contributed to the inflation rate. Variation in the exchange rate is affected by consumer imported goods prices as directly related to depreciation, definitely increasing price level as leads to inflation (Kashif & Khalid 2012). The domestic price level gradually responds to the depreciation of the exchange rate. The exchange rate depreciates when the international traded consumption is shifted to domestic goods by more expensiveness; similarly, the demand for domestic goods rises as well as the factor of production, and this phenomenon has a significant impact on inflation (Zaidi, 2002).

Methodology

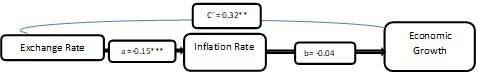

Following Baron and Kenny (1986), this study employs a four-step methodology by regressing different equations and checking their coefficients for significance. The following chart shows the direct and indirect impact of the depreciation of domestic currency on economic growth through different channels, where c' represents the direct effect. Moreover, depreciation of domestic currency on economic growth through different channels is presented by a and b.

If the core variables are significant from step 1 to step 3, then the equation of step 4 is estimated for possible full or partial mediation is regressed.

If the core variables are significant from step 1 to step 3, then the equation of step 4 is estimated for possible full or partial mediation is regressed.

Calculating the Indirect effect

To calculate the indirect effect and test it for significance, the difference between the coefficients was obtained from steps 1 and step 4. The following formula is used to obtain the indirect effect:

BIndirect= ?1 – ?1

Analytical Technique

In order to check the mediating role in the relationship between depreciation of the currency and economic growth, this study uses the time series econometric technique. To ensure that all of the study's variables are stationary, researchers utilised

the Ng-Parron unit root test. This study uses sensitivity analysis and chooses among different econometric techniques, which take into account the endogeneity problem. This study uses Autoregressive Distributive Lag Model (ARDL) to examine the relationship among the variables depreciation of the currency, inflation, and economic growth.

Empirical Findings

Test Results for Unit Roots

This research makes use of NP unit root tests in order to determine whether or not the variables are rationalised. The findings that are shown in table 4.1 make it abundantly evident that the variables that were incorporated into the equation were integrated in a mixed order. The outcomes of the Ng-Perron test are presented in Table 2

Table 2

. Results of the Ng-Perron Test

|

At level |

||||

|

|

MZa |

MZt |

MSB |

MPT |

|

Y |

-5.87745** |

-1.68590 |

0.28684 |

4.25630 |

|

ER |

1.60320 |

1.15302 |

0.71920 |

43.5411 |

|

INF |

-12.9311** |

-2.53895 |

0.19635 |

1.90940 |

|

At 1st difference |

||||

|

|

MZa |

MZt |

MSB |

MPT |

|

Y |

-1.88461* |

-0.87728 |

0.46550 |

11.8714 |

|

At 1st difference |

||||

|

|

MZa |

MZt |

MSB |

MPT |

|

ER |

-17.5593** |

-2.93325 |

0.16705 |

1.50425 |

|

INF |

-4.51200* |

-1.48411 |

0.32892 |

5.46338 |

*, ** and *** represents significance level at 1%, 5% and 10%.

Lag Selection of ARDL

In order to have an accurate picture of how the variables would behave in the long term, it is necessary to use the ARDL econometric procedure. This was determined by the findings of the unit root testing. ARDL is applied in three steps. First, the long-run relationship is estimated. For that purpose, the lag length of the error correction version model is obtained via Schwartz Bayesian Criteria (SBC). In table 4.2, a value of 2 is shown to be the optimal lag time.

Table 3

Optimum Lag Length of overall Model 1

|

Lag |

LR |

FPE |

AIC |

SC |

HQ |

F-test

Statistics |

|

1 |

345.7356* |

3.74e+39* |

105.2991* |

106.5278* |

105.7522* |

2.12 |

|

2 |

31.15108 |

4.74e+39 |

105.4884 |

107.7411 |

106.3191 |

5.76** |

Notes: * indicates

optimum lag.

At the 5% degree of significance, the significant F-statistics value at the appropriate lag length of 2 suggests the existence of a long-term association amongst variables in the model equation.

Inflation as Mediator

Step 1: Y = ?0

+ ?1 ER + ?2X + U

Table 4. Results of Long Run Coefficients

.

|

Regressors |

Coefficients |

|

ER |

-0.18*** |

|

GS

|

0.26** |

|

GFCF |

0.001*** |

|

CON |

0.002** |

|

|

R2

= 0.99 Adjusted

R2 = 0.99 F-statistics

=6.584 Dh

Stat = 2.21 ARDL

Order (1, 2, 0, 0, 1) |

Step 3: Y = g0 + g1 INF + g2 X + U

Table 6. Results of Long

Run Coefficients

|

Regressors |

Coefficients |

|

INF |

-0.04 |

|

MVA |

0.16** |

|

FDI |

0.01*** |

|

|

R2 = 0.97 Adjusted R2 = 0.96 F-statistics = 3.27 (0.01) Dh Stat = 2.04 ARDL Order (1, 0, 1, 3, 2) |

|

Regressors |

Coefficients |

|

ER |

-0.32** |

|

INF |

-0.10 |

|

GFCF |

0.01** |

|

|

R2

= 0.98 Adjusted

R2 = 0.97 F-statistics

=5.68 (0.000) Dh

Stat = 1.95 ARDL

Order (1, 0, 2, 3, 2) |

|

Hypotheses |

Model Variables |

|

Estimates |

P |

Results |

|

H1 |

|

c’ |

-0.18 |

|

Supported |

|

H5 |

|

A |

-0.15*** |

0.09 |

Supported |

|

H6 |

|

B |

-0.04 |

0.18 |

Not Supported |

|

H7 |

|

BIndirect= ?1 – l1 |

0.14 |

--- |

Mediation Not Supported |

Summary of the Results

Conclusion: No Mediation Supported

Conclusion

The exchange rate policy has been assumed to be an important policy, as depreciation is considered to be an imperative component of the traditional stabilisation programs. The potential benefits and drawbacks of currency depreciation on economic expansion have been the subject of heated discussion for a long time. However, the indirect impact of currency depreciation on growth has not received much importance and is neglected. In this research, we analyse how a currency's depreciation has affected Pakistan's economy, both immediately and over time. This study examines whether inflation mediates the depreciation of the currency, which led to the growing phenomenon in Pakistan. This research is based on the mediating role of inflation rate in the relationship between depreciation of the currency and Economic expansion over the period 1972-2016In order to explore the possible connection between a currency's falling value and the rate of economic expansion, the annual data for depreciation of the currency, inflation, economic growth, gross national expenditures, foreign direct investment, manufacturing value-added, gross fixed capital formation and consumption etc. for Pakistan are collected over the period of 1972 to 2016. The main sources are the Economic Survey of Pakistan, State Bank of Pakistan etc. This study uses the mediation channel of inflation rate in the correlation between a currency's decline and the economy's expansion. The results clearly demonstrate that the inflation rate does not support the hypothesis of mediation in the correlation between a currency's decline and the economy's expansion.

References

- Ahmed, K., Qasim, M., & Chani, M. I. (2017). Impact of Exchange rate on Exports in Case of Pakistan. Bulletin of Business and Economics (BBE), 6(2), 98-102.

- Akpan, D. B. (2004). Financial liberalisation and endogenous growth: The case of Nigeria. AIDEP Publication, 32(2), 1-4.

- Akpan, E. O., & Atan, J. A. (2011). Effects of exchange rate movements on economic growth in Nigeria. CBN Journal of Applied Statistics, 2(2), 1-14.

- Alejandro, D. (1963). A Note on the Impact of Devaluation and the Redistributive Effect. (1963). Journal of Political Economy, 71(6), 577–580.

- Ali, T. M., Mahmood, M. T., & Bashir, T. (2015). Impact of Interest Rate, Inflation and Money Supply on Exchange Rate Volatility in Pakistan. World Applied Sciences Journal, 33(4), 620-630.

- Azam, J. P., & Gubert, F. (2006). Migrants’ Remittances and the Household in Africa: A Review of Evidence. Journal of African Economies, 15(Supplement 2), 426–462.

- Bickerdike, C. F. (1920). The Instability of Foreign Exchange. The Economic Journal, 30(117), 118.

- Blanchard, O. J., & Giavazzi, F. (2003). Current Account Deficits in the Euro Area. The End of the Feldstein Horioka Puzzle? SSRN Electronic Journal.

- Borensztein, E., & Gregorio, J. (1999). Devaluation and inflation after currency crises. International Monetary Fund Universidad de Chile

- Chhibber, A., & Shafik, N. (1990). ‘Does Devaluation Hurt Private Investment?’, PPR Working Paper Series, No. 418, World Bank.

- Chou, C. W. L., & Chao, C. (2001), 'Are Currency Devaluations Effective? A Panel Unit Root Test', Economic Letters, 72, 19.

- Choudharyv, M., & Aslam, C. M. (2007). Effects of the Exchange Rate on Output and PriceLevel:Evidence from the Pakistani Economy. THE LAHORE JOURNAL OF ECONOMICS, 12(1), 49–77.

- Easterly, W., & Levine, R. (1997). Africa’s Growth Tragedy: Policies and Ethnic Divisions. The Quarterly Journal of Economics, 112(4), 1203–1250.

- Edwards, S. (1989b). Exchange Rate Misalignment in Developing Countries. The World Bank Research Observer, 4(1), 3–21.

- Eichengreen, B. (2007). The real exchange rate and economic growth. Social and Economic Studies, 7-20.

- Frenkel, R., & Taylor, L. (2006). Real exchange rate, monetary policy, and employment: development in a garden of forking paths . New York: UNDESA.

- Habib, M. M., Mileva, E., & Stracca, L. (2016). The Real Exchange Rate and Economic Growth: Revisiting the Case Using External Instruments. SSRN Electronic Journal.

- Harris, J. R., & Todaro, M. P. (1970). Migration, unemployment and development: a two- sector analysis. The American economic review, 60(1), 126-142.

- Hassan, G. M., & Holmes, M. J. (2013). Remittances and the real effective exchange rate. Applied Economics, 45(35), 4959–4970.

Cite this article

-

APA : Ali, N., Hassan, I. U., & Wahab, A. (2022). The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth. Global Social Sciences Review, VII(I), 417 -427. https://doi.org/10.31703/gssr.2022(VII-I).38

-

CHICAGO : Ali, Naveed, Izhar Ul Hassan, and Abdul Wahab. 2022. "The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth." Global Social Sciences Review, VII (I): 417 -427 doi: 10.31703/gssr.2022(VII-I).38

-

HARVARD : ALI, N., HASSAN, I. U. & WAHAB, A. 2022. The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth. Global Social Sciences Review, VII, 417 -427.

-

MHRA : Ali, Naveed, Izhar Ul Hassan, and Abdul Wahab. 2022. "The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth." Global Social Sciences Review, VII: 417 -427

-

MLA : Ali, Naveed, Izhar Ul Hassan, and Abdul Wahab. "The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth." Global Social Sciences Review, VII.I (2022): 417 -427 Print.

-

OXFORD : Ali, Naveed, Hassan, Izhar Ul, and Wahab, Abdul (2022), "The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth", Global Social Sciences Review, VII (I), 417 -427

-

TURABIAN : Ali, Naveed, Izhar Ul Hassan, and Abdul Wahab. "The Mediating Role of Inflation in the Relationship between Currency Depreciation and Economic Growth." Global Social Sciences Review VII, no. I (2022): 417 -427. https://doi.org/10.31703/gssr.2022(VII-I).38